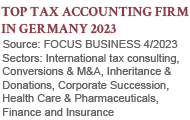

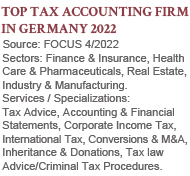

International Tax Law – Criminal Tax Law – Corporate and Group Taxation

– Mergers & Acquisitions (M&A) – Estate Planning and Corporate Succession –

Inheritance and Gift Tax – Transfer Pricing – Real Estate -

Structuring of Real Estate Investments Inbound and Outbound -

Exit Taxation – Crypto Taxation (like Bitcoin)

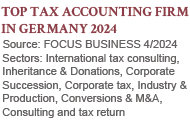

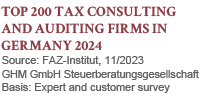

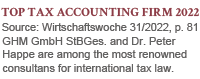

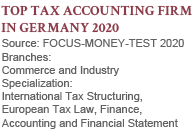

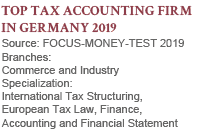

GHM GmbH Steuerberatungsgesellschaft is a tax firm which specialises in international and national tax law, criminal tax law and compliance. Based in Cologne and Munich, it cooperates with numerous tax and law firms both inside and outside Germany.

No matter whether a firm, a professional or a private individual asks us for tax advice - GHM GmbH Steuerberatungsgesellschaft always analyses the overall situation as well as the specific goal, in order to work out the best solution in each individual case. At the same time, we aim to offer each client excellent value for money.

GHM GmbH Steuerberatungsgesellschaft specialises in providing tax advice to enterprises and entrepreneurs at home and abroad.

We also have thorough long-standing experience in advising high net-worth private individuals, health care professionals, hospitals and institutions, e. g. German trusts, off-shore foundations and charitable organisations.