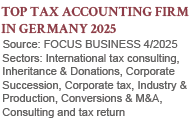

Services

The advisory services we provide focus on the following areas:

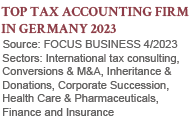

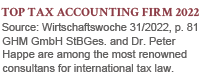

International taxation: We advise German businesses and entrepreneurs investing or setting up companies abroad (outbound investments), and foreign businesses and entrepreneurs investing and setting up companies in Germany (inbound investments). This includes providing advice on selecting the business location, on legal structure and organization, and on financing and transfer pricing, taking into account applicable double taxation treaties.

Non-for-profit organizations: We provide charitable and church organizations such as hospitals, religious orders, unincorporated associations and trusts with advice on foundation and restructuring, charitable donations, endowments and reporting.

Real estate transactions: We provide advice on real estate investments and disinvestments.

Corporate and wealth succession: We provide advice to businesses and high net-worth private individuals on aspects of German inheritance and gift tax law. We also act as executors.

Reporting: We provide advice on reporting under the German Commercial Code, IFRS and US-GAAP.

M&A and restructuring: We advise companies on M&A and restructuring transactions. Appeals, tax audits and fiscal court proceedings: We provide advice in disputes with the German tax authorities.

Appeals, tax audits and fiscal court proceedings: We provide advice in disputes with the German tax authorities.

Business administration: We provide advice on financing, capital expenditure budgeting, cost cutting and financial restructuring.

Start-ups.

We provide advice, prepare memoranda and draft opinions on national and international tax issues under the following statutes and regulations:

We provide advice, prepare memoranda and draft opinions on national and international tax issues under the following statutes and regulations:

Income Tax Act (Einkommensteuergesetz – EStG)

Corporate Income Tax Act (Körperschaftsteuergesetz – KStG)

Trade Tax Act (Gewerbesteuergesetz – GewStG)

Reorganisation Tax Act (Umwandlungssteuergesetz – UmwStG)

Foreign Transactions Tax Act (Außensteuergesetz – AStG)

Double Taxation Treaties (Doppelbesteuerungsabkommen – DBA)

Turnover Tax Act (Umsatzsteuergesetz – UStG)

General Tax Code (Abgabenordnung – AO)

Real Estate Transfer Tax Act (Grunderwerbsteuergesetz – GrEStG)

As regards tax on foreign transactions, we focus on the tax laws of the following countries since they apply in the majority of cases:

Austria

Switzerland

Luxembourg

Belgium

Netherlands

Australia

USA

In these as well as in many other countries, we can refer clients to corresponding firms.

We also prepare memoranda on national and international accounting issues both for single financial statements and for consolidated financial statements (group accounting) under

German Commercial Code (Handelsgesetzbuch – HGB),

International Financial Reporting Standards (IFRS),

United States General Accepted Accounting Practice (US-GAAP) and

German tax accounting rules.

The matters we regularly deal with in this context include financial instruments and derivatives, leasing contracts, real estate, provisions and consolidation issues. We cooperate with leading firms of auditors.

The right Partner

for all your tax affairs

Clients

With our long-standing experience as tax advisors, we provide all-round tax advice to national and international corporate clients and entrepreneurs as well as to private individuals and institutions such as charitable organisations and trusts based at home and abroad. Our clients include e.g. multinationals (DAX 30 listed companies), fund initiators and SME, as well as health care professionals.

Irrespective of size, we devote the same high degree of attention to each of our clients and we safeguard all their interests with the same meticulous diligence.

If we are unable to provide sound advice in any particular area, we can fall back on our large network of tax experts at home and abroad.

Corporates

We provide tax advice to national and international corporate clients and entrepreneurs in the following areas, preparing tax memoranda where required:

Mergers & Acquisitions (M&A)

Due Diligences

Financing and leasing

Restructuring and reorganisation

Outbound investments

Inbound investments

Incorporation and liquidation of corporations and partnerships

Transfer pricing and function transfers

German Foreign Transactions Tax Act

Real estate transactions, e.g. property investments disinvestments and financing

Financial statements under the German Commercial Code, IFRS and US-GAAP for single financial statements as well as consolidated financial statements

Tax accounting in accordance with the German Income Tax Act and Corporate Income Tax Act

Choice of business location and tax planning

Comparative tax burdens

Obtaining advance tax rulings and mutual agreements

Tax audit support and negotiations with German tax authorities

Representation before fiscal courts

Business administration (controlling, calculation of profitability, business plans)

Financial restructuring and insolvency procedure.

On request we offer advice on tax returns, preparing tax returns and financial statements in accordance with legal requirements and accounting regulations, including the necessary documentation (tax compliance).

The right Partner

for all your tax affairs

Individuals

On request we offer advice on tax returns, and our experienced specialised staff prepare individual tax returns and all the necessary documentation (tax compliance). We can also assume the task of executorship.

We advise private individuals in the following areas:

Income Tax

Estate planning and inheritance and gift tax

Business succession and estate planning

Taxation on expatriation and immigration International tax law

International tax law

Capital and real estate investments and divestments

Withholding tax on capital investments

Financing

Tax audit support as well as representation in negotiations with German tax authorities

Tax fraud representation

We are experienced in providing advice to the following professions:

Health care professionals e. g. physicians and pharmacists

Artists and athletes

Engineers and inventors

Business consultants

Lawyers, patent attorneys, insolvency administrators and notaries public

Institutions

We provide advice to institutions in the public and private sector and to both profit-making and non-profit organisations inside and outside Germany, e.g.:

We provide advice on the legal aspects of charitable donations and non-profit activities.

On request we also offer advice on tax returns, preparing tax returns and all the necessary documentation (tax compliance) for the tax administration and other authorities (e.g. for the regulatory authority for trusts and foundations at the Department of the Interior).

Business Sectors

Our team of tax experts has wide experience in advising companies in the following sectors:

Non-profit-making organisations/NGO

Closed-end funds (real estate, secondary market for life insurance policies and infrastructure)

Private equity and hedge funds

Open-end funds

Asset management

Automotive, including suppliers and dealers

Brand manufacturers

Real estate

Health care (pharmaceutical, bio-tech, medical devices, hospitals, health care professionals)

Energy

Metalworking

Commercial and investment banking

Insurance

Commerce, especially distance trading

Aviation

Leasing